Urban legends, urban myths, and the latest that’s on everyone’s lips–fake news. Whatever you call it, in our age of information, claims of spurious repute can go viral in minutes. Anyone with a PC can start a blog and offer up opinions on just about any subject, whether he or she is an authority or not. Sources? Who needs sources.

OK, there’s a bit of sarcasm in that last comment, but I think you know where I’m going.

When it comes to retirement, there are plenty of misleading thoughts, opinions and fake news floating around out there. This month, I’d like to clear up some misconceptions that surround the retirement years. With that in mind, let’s jump in.

1. I’ll never see a penny of the money I put into Social Security. If I had a nickel every time I heard someone utter that phrase. Sadly, if a 40-something says he is confident he will receive monthly checks, he sets himself up for ridicule among his contemporaries.

I wouldn’t disagree with the hypothesis that young people getting started in the workforce will receive a low return on contributions into Social Security, but that’s a completely different argument.

Back to the matter at hand, Social Security is not on the verge of bankruptcy, and I fully believe even those who are many years from retirement will be collecting monthly benefits when it’s their turn. Let me explain.

According to the 2017 annual report from the Social Security and Medicare Board of Trustees, Social Security “has collected roughly $19.9 trillion and paid out $17.1 trillion,” in its storied 82-year history, “leaving asset reserves of more than $2.8 trillion at the end of 2016 in its two trust funds.”

As an ever-larger number of baby boomers continue to retire and collect benefits, the trustees expect the trust funds to be depleted by 2034.

Thereafter, expected-tax-income receipts are projected to be sufficient to pay about three-quarters of scheduled benefits. Put another way, recipients of Social Security would receive about a 25% cut in benefits, if no changes are made to the current structure.

Of course, these are simply projections and much will depend on economic growth, job creation, and wages. Yet, it’s a far cry from, “I won’t see a penny of Social Security.”

I suspect that politicians will eventually settle on some type of compromise that will extend the life of the current system.

That said, I recognize that timing and strategies that can be implemented for Social Security may be complex. If you have questions, please give us a call or shoot us an email. We would be happy to discuss your options with you.

2. The stock market is too risky. There’s no question about it, the bear markets that followed the dot.com bubble and the 2008 financial crisis were unprecedented, in that we saw two steep declines in less than 10 years.

Made fearful by what they see as too much risk, millennials have shied away from stocks, according to a Bankrate survey. What seems like a complete disconnect: Millennials seem to be far more interested in Bitcoin! The word speculative doesn’t even begin to describe Bitcoin. But let me get back on topic.

There has always been a degree of risk in stocks, even with a fully diversified portfolio. Yet, a well-diversified portfolio is akin to a stake in the U.S. and global economy. Moreover, the U.S. and global economy has been expanding for many decades. It may not be larger next year, but history tells us it will be bigger in 10 or 20 years.

When it comes to investing in stocks, I typically experience some resistance from folks who haven’t seriously entertained the idea before. I listen to their concerns, and answer with an array of factual data that’s not designed to win an argument, but simply to educate. When you have all the facts, then you can make an educated decision about what’s best for you.

3. Medicare will handle all my health care needs in retirement. If only Medicare did cover everything. But then, the cost to finance it would be much higher.

Medicare doesn’t cover the full cost of skilled nursing or rehabilitative care, according to AARP. Yes, the first 20 days of a stay in a nursing home is covered, but you’ll pay over $160 per day for days 21 through 100. And Medicare doesn’t cover stays past 100 days.

You may be paying out of pocket for personal care assistance, too. The same holds true for miscellaneous hospital costs, routine eye exams, hearing, foot and dental care.

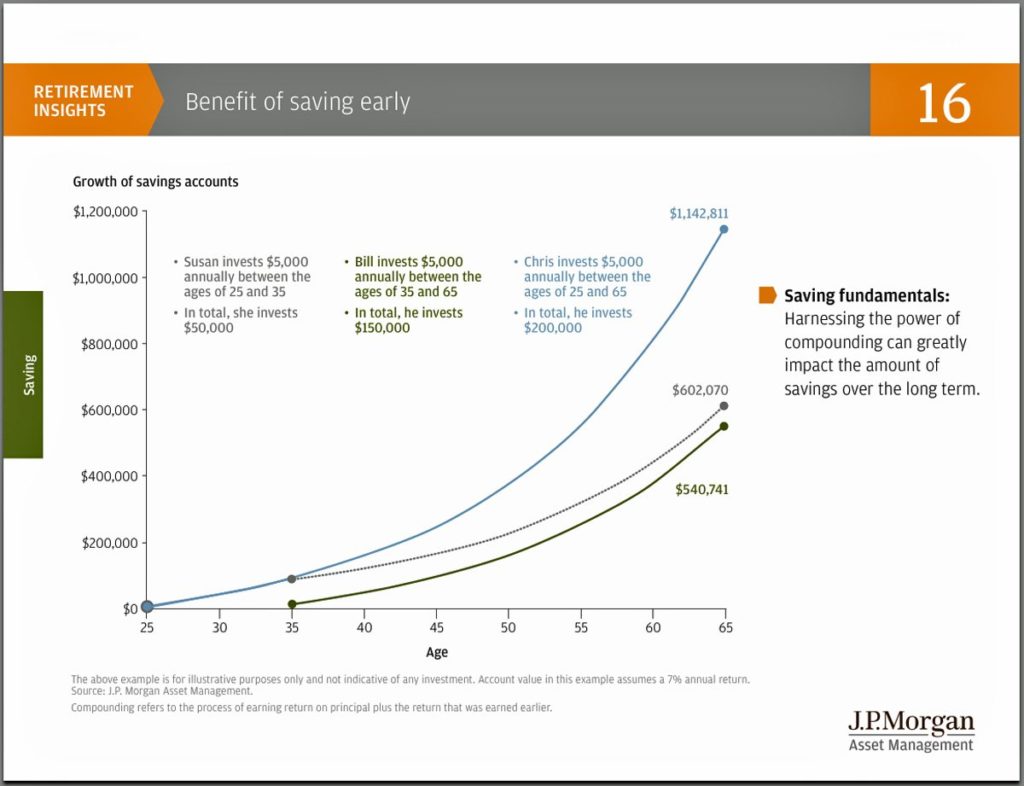

4. Why save today when you can start tomorrow—there’s plenty of time. This section is designed for millennials and those who are just beginning their journey in the workforce. There’s no better day to begin saving than today! I can’t stress this enough.

Let me give you a simple but telling example.

Susan invests $5,000 annually between the age of 25 and 35 and earns 7% annually. She puts away a total of $50,000.

Bill invests $5,000 annually between the age of 35 and 65 and earns 7% annually. He saves a total of $150,000.

When Susan reaches 65, she will have amassed $602,070, while Bill will have $540,741.

Source: JP Morgan Asset Management

Lesson learned–the sooner you begin, the better off you will be as you approach retirement.

Take full advantage of your company’s retirement program. If your company doesn’t have a savings plan, there are many simple ways that you can get started. Feel free to reach out to me and I can assist you.

5. Retirement is easy. Many look forward to the day when they will no longer prepare for Monday mornings at the office. For those who face the work challenges that crop up daily, retirement may seem like a welcome oasis in the distance.

But that oasis sometimes turns out to be a mirage. Often, the transition from decades of working to retirement isn’t so simple.

For a better retirement, set goals, and not simply financial ones. Can you transition to part-time in your job? Consider part-time employment or consulting. It will ease the transition, keep you busy, and extend your savings.

Volunteer with your local church or local community organizations. Are you familiar with Meetup.com? Look for groups with similar interests. You’ll not only derive an enormous amount of satisfaction from helping others, but you’ll meet like-minded folks and make new friends.

Try something new. Maybe piano, an art class, or a second language.

Please, keep up any exercise routines—and it’s never too late to start a new one. Check with your doctor, who will be happy to prescribe a fitness plan that’s suited to you.

Have you ever considered taking a class? How about writing a book? Expanding your knowledge or sharing your ideas can be quite fulfilling.

The most important thing you can do to make retirement enjoyable is to stay active and keep your mind and body sharp.

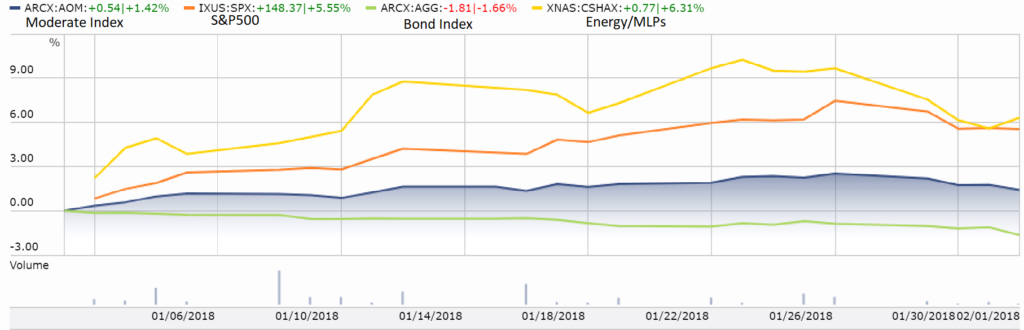

Any thoughts that 2018 might start with a pause in the bull market were quickly dispelled in the first week of the year. A “buy the rumor, sell the news” view on tax reform has shaken out to be more aptly described as buy the rumor and buy the news.

In my opinion, the credit goes to the dramatic reduction in the corporate tax rate—from 35% to 21%, beginning in 2018.

On January 1, analysts were forecasting a 12.2% rise in Q1 2018 S&P 500 profits (Thomson Reuters) —pretty impressive. By January 31, analysts had sharply raised the Q1 estimate by a full 5 percentage points to 17.2%.

There’s only one word to describe the dizzying upward surge in estimates—astounding. And it’s not simply Q1 2018; analysts have sharply boosted profit outlooks for all four quarters.

As I’ve mentioned in the past, earnings and expectations of earnings play a big role in the stock market price equation. The run-up we’ve witnessed, in my view, is due to investors pricing in a much rosier profit outlook

Warren Buffett, who called the cut in the corporate tax rate a “big deal…a huge, huge reduction,” summed it up this way in a CNBC interview in the middle of last month—

“You had this major change in the silent stockholder in American business, who has been content with 35%…and now instead of getting a 35% interest in the earnings (he noted foreign earnings from U.S. firms are more complicated) they get 21% and that makes the remaining stock more valuable.”

It’s a unique and colorful way to describe the new tax regime.

By month’s end, a modest bout of volatility re-entered the landscape, as investors took note of an upward creep in Treasury bond yields. It’s a reminder that stocks don’t rise in a straight line.

Let me end this month’s newsletter with a recent comment by Burton Malkiel.

He’s not a household name like Buffett, but he is the author of A Random Walk Down Wall Street, a well known and well-respected book published in 1973.

“I think one of the cardinal rules of investing is don’t try to time the market. And the reason is that you’ll never get it right. I’ve been around this business for 50 years and I’ve never known anyone who could time the market and I’ve never known anyone who knows anyone who could time the market. You can’t do it. It’s very dangerous.”

I hope you’ve found this review to be educational and helpful.

Let me emphasize again that it is our job to assist you! If you have any questions or would like to discuss any matters, please feel free to give us a call.

As always, we are honored and humbled that you have given us the opportunity to serve as your financial advisor.

Provided by Palmer Nunn Wealth Management

Securities offered through KMS Investments, Inc. Member FINRA & SIPC. Investment advisory services offered through KMS Advisors, LP. This material was prepared by Horsesmouth LLC and does not necessarily represent the views of the KMS Financial or their affiliates. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

© Copyright 2026 Palmer Nunn, Inc, All Rights Reserved. | Website Design by WABW Media Group